Invest in the Future with Incentives and Programs

The state works with new and expanding employers that create a higher standard of living, enhance the local and state economies, and increase revenues to local and state governments. Incentives are the state’s investment in its economic future and a business decision for the company, region, and state.

Designed to target the needs of the company, a variety of performance-based incentives are available. From tax credits to tax exemptions, companies benefit from investing in the Roanoke Region.

Local Incentives

- Two Enterprise Zones provide state and local incentives to businesses that invest and create jobs.

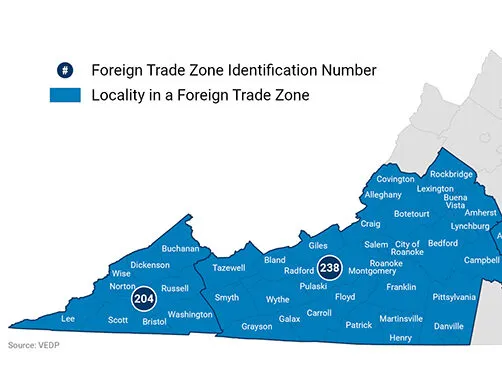

- The Roanoke Region is a Foreign Trade Zone, which is designed to help and encourage businesses to participate in international trade by effectively eliminating or reducing customs duties.

- Opportunity Zones provide banks, communities, investors, companies, and others direct tax-advantaged investments to one of several opportunity zones in the Roanoke Region of Virginia.

State Incentives

- Virginia Commonwealth’s Opportunity Fund (COF) is a discretionary incentive available to the governor to secure a business location or expansion project for Virginia. Grants are awarded to localities on a local matching basis with the expectation that the grant will result in a favorable location decision for the Commonwealth.

- Virginia Jobs Investment Program (VJIP) offers customized recruiting and training assistance to companies creating new jobs or experiencing technological change. Designed to reduce the human resource development cost of new and expanding companies.

- The Governor’s Agriculture and Forestry Industries Development Fund (AFID) is a new tool for communities within the Commonwealth to grow their agriculture and forestry industries through strategic grants made to businesses that add value to Virginia-grown agriculture and forest products.

- State incentives and grants are also available for transportation access, rail development, port usage, and the use of clean energy.

Learn More about the Roanoke Region of Virginia